Often, they would present the best possible deal to you which means that there’s no chance for you to negotiate. Then again, there are downsides to working with your bank as well.

This means that you’ll get the direct pricing without the additional markup. The biggest advantage of financing your RV through your bank is that you don’t have to deal with an intermediary when you make your purchase. Your bank may even grant you some leniency should you end up missing one of your installments. When you work with your own bank, this may give you more confidence that they will work hand-in-hand with you to find the best possible deal to finance your RV. Just like when you finance with a dealer, this option comes with its own pros and cons. The other most popular financing option for RVs is through your bank. Therefore, you should only finance through a dealer if you trust them enough to find the best possible deal for you. Also, some dealers offer very low financing rates through sales and promotions. You may even want to call some of their customers to check if they’re happy with the agreement they had with the dealer.Ī lot of people prefer this option because the process is convenient and quick. Check the reviews of the dealer you’re interested in to find out if any of their customers have divulged information about their interest rates and their financing procedures. Just like other purchases which require large amounts of money, most people finance their RV just like when they purchase a car, a boat or even a house.Īfter you’ve used the RV loan calculator to determine how you can pay for your RV, you may also want to look into the various financing options including:īefore you choose to finance through a dealer to buy the RV of your dreams, you must do your research.

Finance calculator rv full#

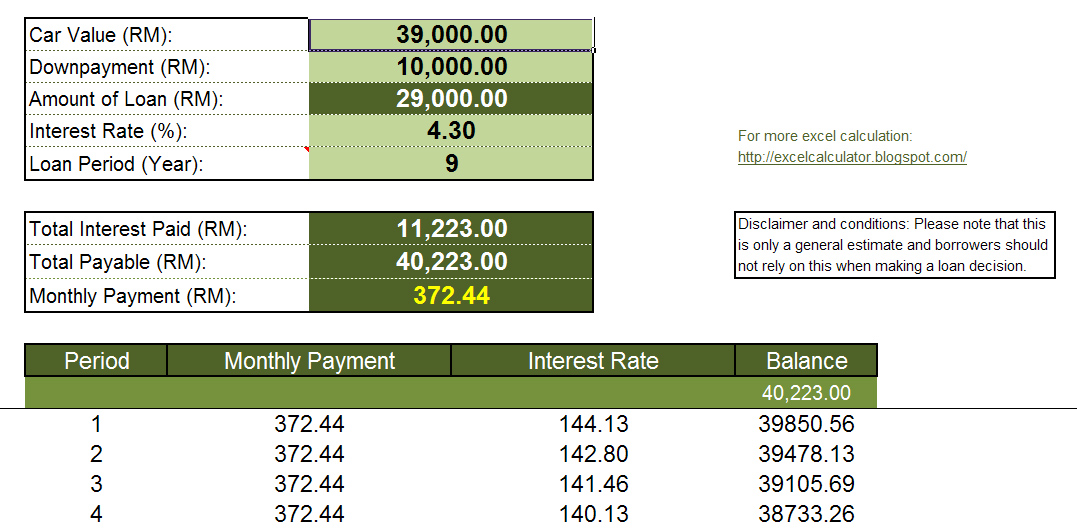

Seldom would people go to an RV dealership with suitcases full of money to pay for their RV in cash. Before you do, you may ask them about their interest rates. Although most people loan from banks, there are other financial institutions you may borrow money from. When it comes to the interest rate, this would depend on where you plan to purchase your RV and which financial institution you plan to apply for your RV loan. What is the current interest rate for RV loans? Some lenders also allow you to customize your financing terms depending on the negotiations you have as you make your financing agreement. To find out which type of financing term to choose, use this RV financing calculator to guide you. As aforementioned, you can either opt for long-term or short-term financing based on your current resources. Most of the lenders offer more flexible terms in terms of financing whether you plan to purchase a used or a new RV.

Typically, RV loans come with financing terms which range between 10 to 20 years. Conversely, short-term financial plans mean you won’t have to pay as much overall but you need to pay a higher amount at the beginning.Įither way, using this RV payment calculator helps you determine the best course of action in terms of taking out a loan to purchase your RV.

Long-term financial plans mean that you don’t have to spend a lot now but you’ll end up paying more in the end. This RV loan payment calculator can help you make the best financial decisions depending on your resources. Use it to determine the monetary values before committing to a purchase as expensive as this one. If you have similar plans, you can determine the best financing options for your loan using this RV loan calculator. Instead, they take out a loan to pay for the RV of their dreams. Most people won’t pay outright for this kind of vehicle because they are extremely expensive. The most important of which is the price of the RV. If you plan to purchase an RV, there are a lot of things to consider.

0 kommentar(er)

0 kommentar(er)